The central government on Monday informed

Parliament that it earns almost Rs 33 from the sale of every litre of

petrol and Rs 32 from per litre of diesel.

Centre earns around Rs 33 on the sale of each litre of petrol, the govt has told Lok Sabha | Picture Credits: PTI

Even as the petrol and diesel prices continued to stay at the all-time high for the 16th

straight day on Monday, the Centre told Parliament that it earns a huge

amount of revenue from fuel via excise duty, cess and surcharge.

The

central government admitted that, since May 6, 2020, it has been

earning Rs 33 per litre of petrol and Rs 32 on a litre of diesel in form

of central excise duty, including basic excise duty, cess and

surcharge.

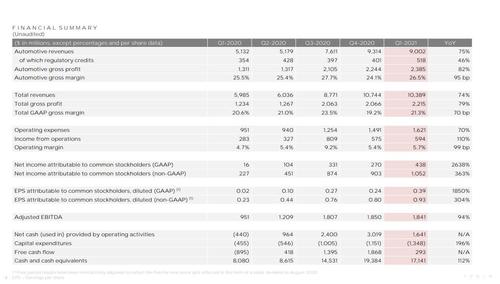

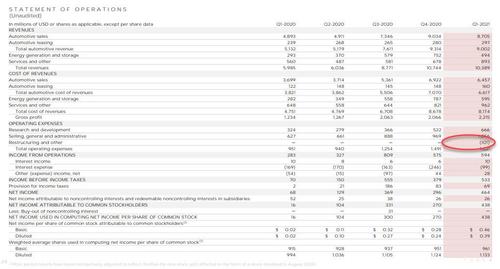

In comparison, between March and May 5, 2020, the

central government’s per litre earning on petrol and diesel was almost

Rs 23 and Rs 19, respectively on one litre of diesel (SEE TABLE).

Table: Details of total central excise duty, including basic excise duty, cess and surcharge.

Between

January 1, 2020, and March 13, 2020, only Rs 20 on a litre of petrol

and Rs 16 on a litre of diesel were going to the Centre.

This means, compared to January 1, 2020, the government earning were up by Rs 13 on each litre of petrol and Rs 16 on diesel.

POLITICAL FLAK OVER PRICE FREEZE

The

government has been facing political flak for both a high levy on fuels

and for putting a freeze on fuel prices as five state assemblies head

towards polls.

The opposition has been questioning the

“politically fixed freeze” in fuel prices as rates of petroleum products

in the country are benchmarked to international product prices.

In

reply to a query in Lok Sabha, MoS Finance Anurag Thakur informed that

“generally, the prices of petroleum products in the country are

higher/lower than other countries due to a variety of factors, including

prevailing tax regime and subsidy compensations by the respective

governments, the details of which are not maintained by the government”.

Justifying

the high levies on fuel, he said, “The excise duty rates have been

calibrated to generate resources for infrastructure and other

developmental items of expenditure keeping in view the present fiscal

position.”

“Consumer Price Index-Combined (CPI-C) inflation has

declined from 7.59 per cent in January 2020 to 4.06 per cent in January

2021. CPI—‘Petrol for vehicle’ inflation has increased from 7.38 per

cent in January 2020 to 12.53 per cent in January 2021. CPI—‘Diesel for

vehicle’ inflation has increased from 6.44 per cent in January 2020 to

12.79 per cent in January 2021,” he said.

The government has,

however, been silent on why the oil companies have not changed prices

for over two weeks when the prices of fuels are linked to global crude

prices and calibrated daily.

The last time prices were calibrated

was on February 27, 2021, when the petrol price was hiked by 24 paise

per litre and diesel raised by 15 paise.

Meanwhile, consumers

continue to pay high prices for fuels despite the freeze all over the

country. On Monday, unbranded petrol was retailing in Delhi at Rs 91.17

per litre while diesel was Rs 81.47. In Mumbai, petrol was retailing at

Rs 97.57, while diesel cost Rs 88.60.

CENTRE-STATE SHARE IN FUEL TAXES

In

February, the price of petrol had crashed past the Rs 100-mark in two

places in Rajasthan and Madhya Pradesh. These two states levy the

highest VAT on fuel in the country.

The central and state levies

make up for 60 per cent of the retail selling price of petrol and over

54 per cent of diesel price. If a consumer is paying Rs 100 for a litre

of petrol, almost Rs 33 goes to the Centre, while it’s Rs 32 on a litre

of diesel.

The states cannot complain as not only they charge

their own levies but also get 42 per cent of the central collections,

excluding the cess and surcharge component, as their share, as per the

finance commission recommendation.

‘NO PLANS TO INCLUDE FUEL IN GST LIST’

While

experts have said that the only way to provide relief to the consumer

is to add fuels to the GST list, the states and Centre are reluctant to

do so, given the revenue the fuels bring in to them.

Replying to

question on inclusion of fuels in the GST regime, Anurag Thakur told Lok

Sabha: “Article 366 of the Constitution provides “Goods and Services

Tax” means any tax on supply of goods, or services or both except taxes

on the supply of the alcoholic liquor for human consumption. Thus, the

supply of above petroleum products is not excluded from the purview of

GST.”

However, he added, “Article 279 A (5) of the Constitution

prescribes that the Goods and Service Tax Council shall recommend the

date on which the goods and services tax be levied on petroleum crude,

high-speed diesel, motor spirit (commonly known as petrol), natural gas

and aviation turbine fuel (ATF), also as per the Section 9(2) of the

CGST.”

Through

the finance minister, the government informed the House that inclusion

of these products in the GST list will require the recommendation of the

GST Council.

In a signal that the government is staying

non-committal on the issue, Anurag Thakur told Lok Sabha: “So far, the

GST Council, in which the states are also represented, has not made any

recommendation for inclusion of these goods under GST. The Council may

consider the issue of inclusion of these five petroleum products at a

time it considers appropriate keeping in view all the relevant factors

including revenue implication.

“At present, there is no proposal

to bring crude petroleum, petrol, diesel, ATF and natural gas under GST.

As regards other by-products the same are already under GST,” he said.

Venture capital fund exits in Indian startups surged in 2021, says a report. Here’s why.

Venture capital fund exits in Indian startups surged in 2021, says a report. Here’s why.